sales tax calculator tulsa ok

Tax Return Preparation Tax. This is the total of state county and city sales tax rates.

Ti 84 Calculators For Sale In Tulsa Oklahoma Facebook Marketplace Facebook

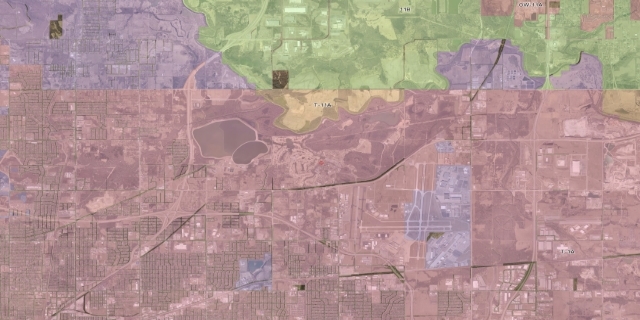

This takes into account the rates on the state level county level city level and special level.

/https://s3.amazonaws.com/lmbucket0/media/business/3SJU_Tulsa_OK_20220921212929_Ext_01.8361d0fe01f01c1987e590fbad4e71a232365914.jpg)

. The average cumulative sales tax rate between all of them is 828. The December 2020 total local sales tax rate was also 8517. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

Tulsa has parts of it located within Creek County. Average local state sales tax. Ad A brand new low cost solution for small businesses is here - Returns For Small Business.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Tulsa OK Sales Tax Rate. New Tulsa OK Sales Tax Rate.

Our tax preparers will ensure that your tax returns are complete accurate and on time. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Just enter the five-digit zip.

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. Sales tax in Tulsa Oklahoma is currently 852. The calculator will show you the total sales tax amount as well as the.

You can calculate Sales Tax manually using the formula or use the Tulsa Sales Tax Calculator or compare Sales Tax between different locations within. The current total local sales tax rate in New Tulsa OK is 5800. The Oklahoma sales tax rate is currently.

As far as all cities towns and locations go the place. You can calculate Sales Tax manually using the formula or use the Tulsa County Sales Tax Calculator or compare Sales Tax between different locations. The excise tax for new cars is 325 and for used cars the tax is.

Sales tax in tulsa oklahoma is currently 852. This includes the rates on the state county city and special levels. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county. Sales Tax Rate s c l sr.

The most populous location in Tulsa County Oklahoma is Tulsa. Ad Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos. Sales tax in Tulsa County Oklahoma is currently 487.

The December 2020 total local sales tax rate was also 5800. Sales Tax in Tulsa. The current total local sales tax rate in Tulsa OK is 8517.

The sales tax rate for Tulsa County was updated for the 2020 tax year this is the current sales tax rate we are using in the Tulsa. The average cumulative sales tax rate in Tulsa Oklahoma is 831. You can use our Oklahoma Sales Tax Calculator to look up sales tax rates in Oklahoma by address zip code.

The average cumulative sales tax rate in the state of Oklahoma is 771. The oklahoma state sales tax rate is currently. Name A - Z Sponsored Links.

Ad A brand new low cost solution for small businesses is here - Returns For Small Business. Sales Tax Calculator in Tulsa OK. 70 455 7455.

State of Oklahoma 45. Sales Tax Rate s c l sr. The sales tax rate for Tulsa was updated for the 2020 tax year this is the current sales tax rate we are using in the Tulsa Oklahoma.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does. The 8517 sales tax rate in tulsa consists of 45 oklahoma.

Woodspring Suites 11 Reviews 11000 East 45th St Tulsa Ok Yelp

Tax Calculator Chanute Ks Official Website

Oklahoma Sales Tax Calculator And Local Rates 2021 Wise

Oklahoma Sales Tax Calculator And Economy 2022 Investomatica

Tulsa Real Estate Market Trends And Forecasts 2020

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Owasso Oklahoma Business And Sales Tax Rates

How To Calculate Cannabis Taxes At Your Dispensary

Marijuana Tax Preparation Guide For Business Owners Polston Tax

Oklahoma Sales Tax Handbook 2022

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank Pdffiller

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

7820 E 6th St Tulsa Ok 74112 Zillow

Reasons To Move To Tulsa Oklahoma Movebuddha